Bridge Loan

A bridge loan is a short-term loan used until a person or company secures a permanent financing or pays an existing obligation. It allows the borrower to meet the current obligations by providing immediate cash flow. This loan have high Interest rates and are usually backed by some form of collateral, such as real estate or the inventory of a business.

Business Scenarios:

For a Bridge loan,depending on the answer chosen during the Origination application submission the mentioned business scenarios ,business use case and the connected loan section display in the assist.The dependency rules get triggered during execution of each task and the collaterals get created/updated in the transact.

Below are the four business scenarios and business use cases of Bridge loan (refer attached excel for more details).

- Scenario -1: Customer already having Mortgage Loan (in same bank) and now seeking BL for the same Property used for Mortgage Loan.

- Scenario - 2: Customer applying Mortgage Loan and also seeking BL in the same application- using two different Properties (This is ideally a Bundled Loan).

- Scenario - 2A: Customer First applied Mortgage Loan (In-Progress) and subsequently seeking BL - using another Property.

- Scenario - 2B: Customer First applied Mortgage Loan (Completed) and subsequently seeking BL - using another Property.

- Scenario - 3: Customer applying for a BL (Standalone BL) using a Property (There is a Mortgage Loan with external Bank on this Property-Second Charge).

- Scenario - 4: Customer applying for a BL (Standalone BL) using a Property (There is NO Mortgage Loan against this property in any Bank - First Charge).

Click here for details regarding Bridge Loan flow in Origination (Pre-Submission).

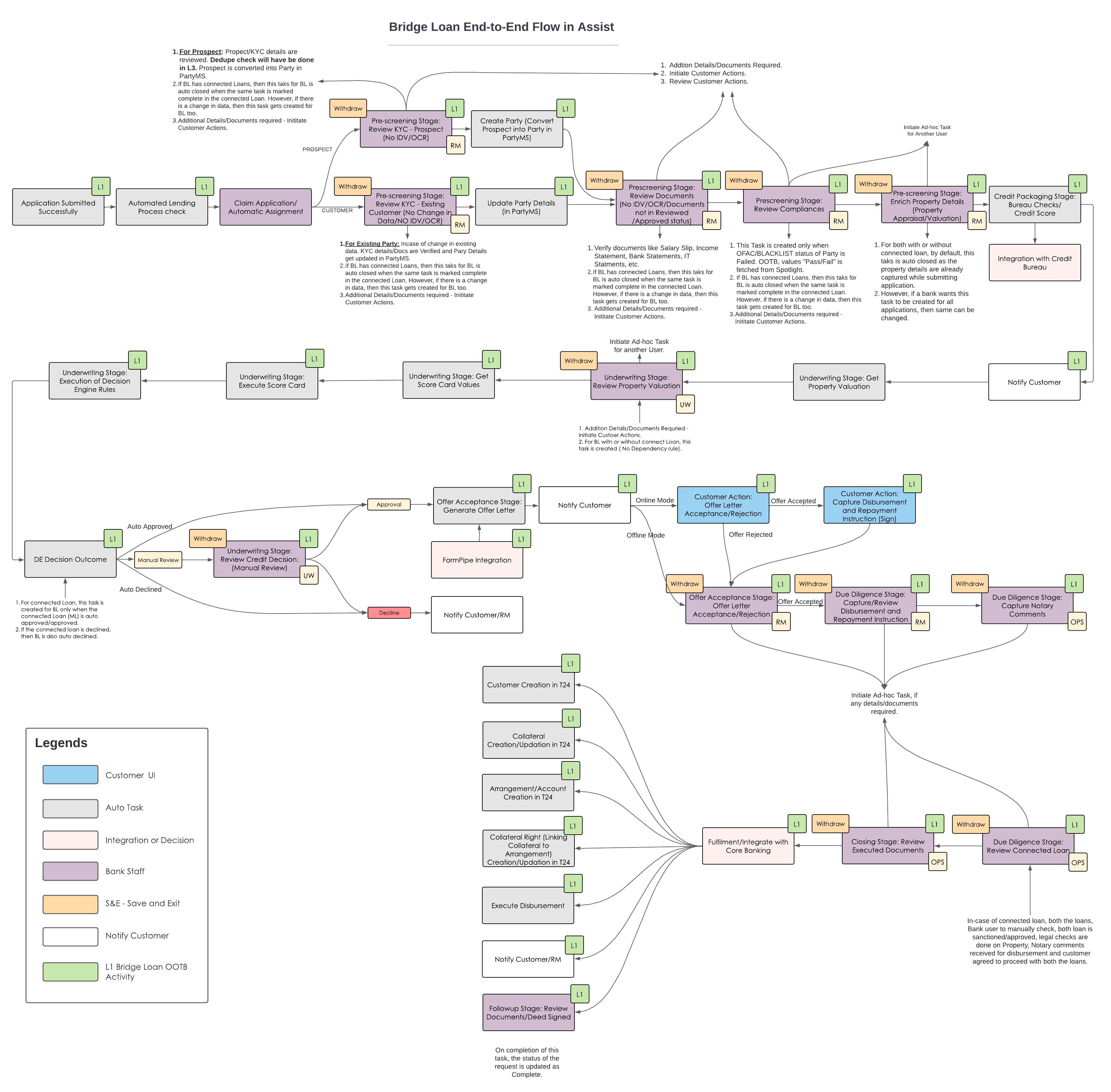

Bridge Loan Workflow in Assist

Horizontal view of the flow

Click here for a broad view image of the end-to-end Bridge Loan workflow in Assist.

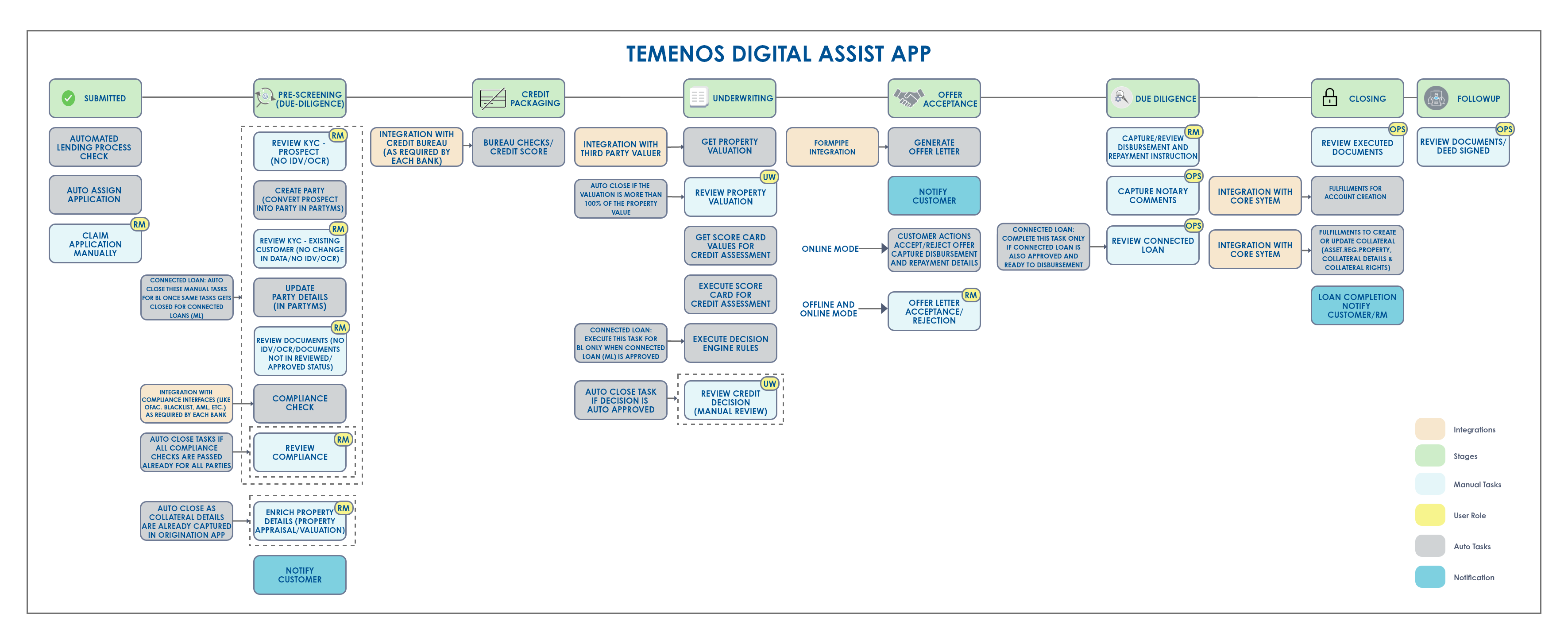

Vertical view of the Workflow Stages

Workflow Stages

- Submitted

- Prescreening

- Credit Packaging

- Underwriting

- Offer Acceptance

- Due-Diligence

- Closing

- Follow-up

Reference Links

In this topic